In this article, we are going to talk about the best ai tool for indian stock market. If you invest or trade on the stock market, then AI tools can make your work much easier and faster.

Friends, in the present time, artificial intelligence is continuously increasing its capabilities and is playing an important role in almost every field. Keeping in mind its strong creativity, artificial intelligence is successfully performing amazing tasks like art, photo, and video generation, so how is the stock market going to remain untouched?

Many companies have trained their artificial intelligence tools by providing detailed data that is capable of making very good decisions according to the circumstances.

If you are looking for some amazing AI tools for your stock market, then we have told you about the 5 best AI tools that provide very good data, keeping in mind the Indian stock market. All these artificial intelligence tools help you perform better than others, so let us know in detail about the five AI tools.

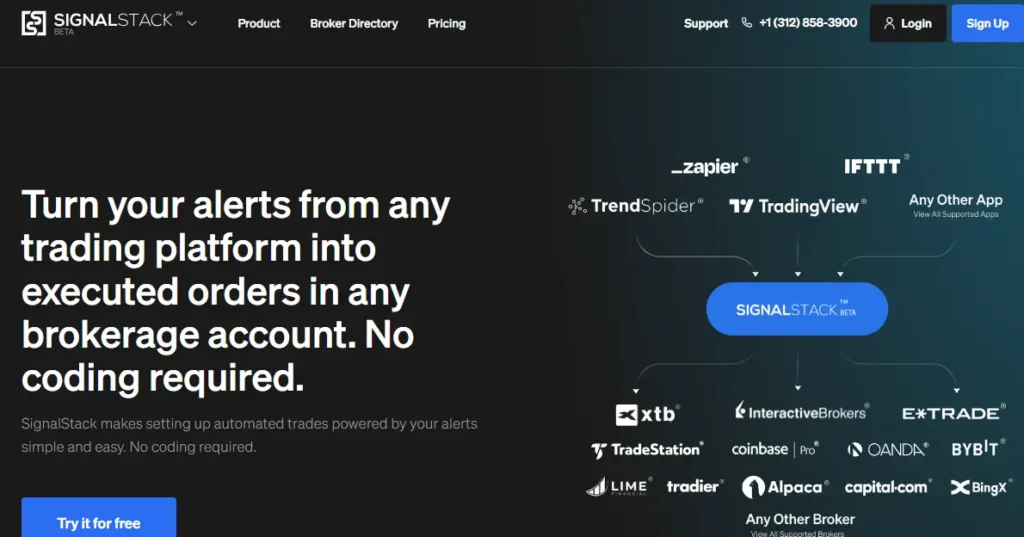

1. Signalstack

Signalstack is an integration layer designed to make it easy to automatically place orders in a brokerage account. This serves to link alerts from the trading platform of choice to the brokerage or exchange account of one’s choice. Signalstack automates trades based solely on alerts from the trading platform and does not provide any alerts, signals, research, analysis, or trading advice. It is very easy to set up, with no coding required. It is able to work with multiple charting platforms and brokers. Also, its fast and reliable order execution makes it better than others.

Benefits:

- Easy to use, no coding required

- Connects to a variety of brokers and platforms

- Automates trades quickly and reliably.

- Supports a variety of order types.

Limitations:

- Does not provide business advice.

- Users are responsible for their own decisions.

- Trading involves risk.

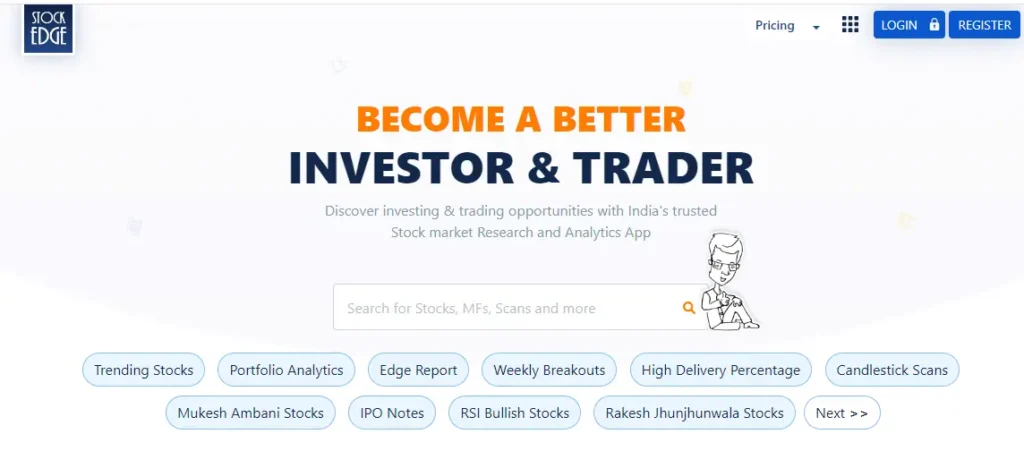

2. Stockedge

Stockedge is an Indian stock market research and analysis platform that offers its services in the form of a mobile app and website. It is specifically designed to empower the user with the tools and information needed to make informed decisions in the stock market. It focuses heavily on research and analysis, offering fundamental and technical analysis based on Indian NSE and BSE data. It provides educational resources for beginners. It comes with a very easy-to-use interface, which is quite easy for a beginner to understand and navigate.

Benefits:

- Analyze stocks deeply (data and analysis).

- Beginner-friendly interface

- There are many tools for different needs.

- Learn about the market (resources).

Limitations:

- Limited free features (pay for some)

- Only analyzes Indian stocks

- Requires understanding data (DIY).

3. Kavout

Kavout is a global investment company that helps people all over the world invest their money in the right place. “Cavout” is a French word meaning to find. Kvout is committed to helping discover new investment opportunities and achieve the best returns. It empowers the user to make smarter, faster, and better-informed decisions using the latest technology and artificial intelligence. Kavout uses the K score to reflect a variety of factors, including company fundamentals, pricing and trading volume data, and technical indicators.

Benefits:

- Uses AI to find investment options.

- Provides data and guidance.

- Saves time on research.

Limitations:

- It’s not a sure thing (past results are not guaranteed).

- Recommendations are unclear (“black box”).

- May be biased.

- The cost is included.

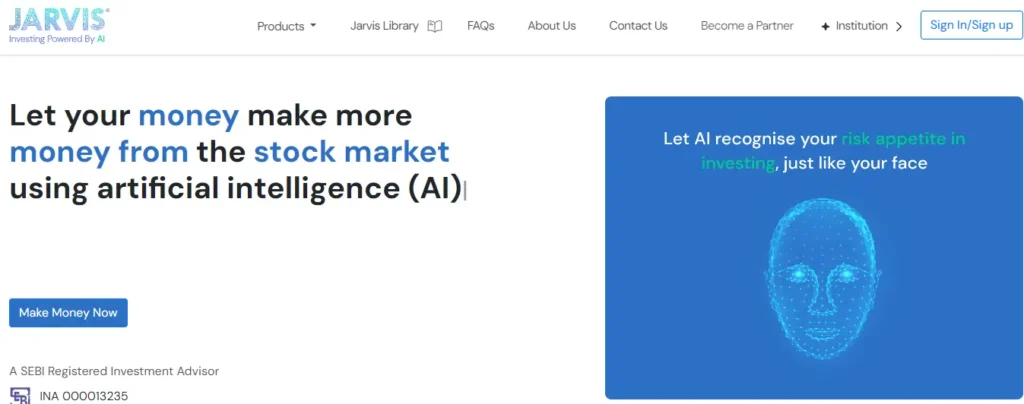

4. Jarvisinvest

Jarvisinvest is a SEBI-registered investment advisor that uses the latest technology, AI, to create personalized stock portfolios for its users. Being SEBI-registered, it becomes a very reliable AI tool for the Indian stock market. It offers three product types: Jarvis Portfolio, Jarvis Protect, and Jarvis One Stock, to meet the needs of different investors. It rebalances over time to identify new opportunities using artificial intelligence. This is a very good platform for investors making long-term investments.

Benefits:

- Create personalized portfolios.

- Uses AI to select stocks

- Manage risk 24/7.

- Rebalance portfolios to find new opportunities.

- It avoids human error and bias.

- Offers short-term profit opportunities.

Limitations:

- May not provide quick returns.

- Requires a long-term investment horizon.

5. Auquan

Auquan is a financial company primarily known for applying generative artificial intelligence to the financial services industry. It helps in finding the best investment opportunities by studying the hard data of the stock market through AI. It uses retrieval-augmented-generation AI to analyze vast amounts of data, including unstructured sources. Additionally, other knowledge-intensive tasks like Know Your Customer (KYC) checks, ESG research, and risk monitoring can be automated. Due to the use of artificial intelligence in this platform, time spent on manual data collection and analysis is saved to a great extent.

Benefits:

- Saves time by automating data tasks.

- Uncovers hidden patterns to make better decisions.

- Provides unique data for private markets.

Limitations:

- Human expertise is required to interpret the results.

- Systems can be expensive to implement and maintain.

FAQs: Best ai tool for indian stock market

Artificial intelligence can provide somewhat accurate information about short-term stock trends, but it is not perfect. Use it only as a tool in conjunction with other research, not as a guarantee of success.

We want to tell you clearly that this is a tool and there is no magic formula; hence, there is no guarantee that AI trading can be profitable. Make your own policy and use it wisely.

AI trading is not a risky move, but it cannot be called safe either. Using AI blindly can prove to be a very dangerous move, so use it wisely as a tool.

It is true that AI leads in speed and data for high-frequency trading, but humans bring experience, intuition, and adaptability. If both AI and human expertise are combined, the chances of success in trading increase.

Conclusion

I always hope that you will find the above article on the best AI tool for the Indian stock market quite helpful. Friends, we want to tell you once again that you should use AI tools as a tool to make your research easier. You should not use AI tools blindly; otherwise, you may have to take a lot of risks. The combination of both AI and human experts can significantly increase your chances of success in trading.